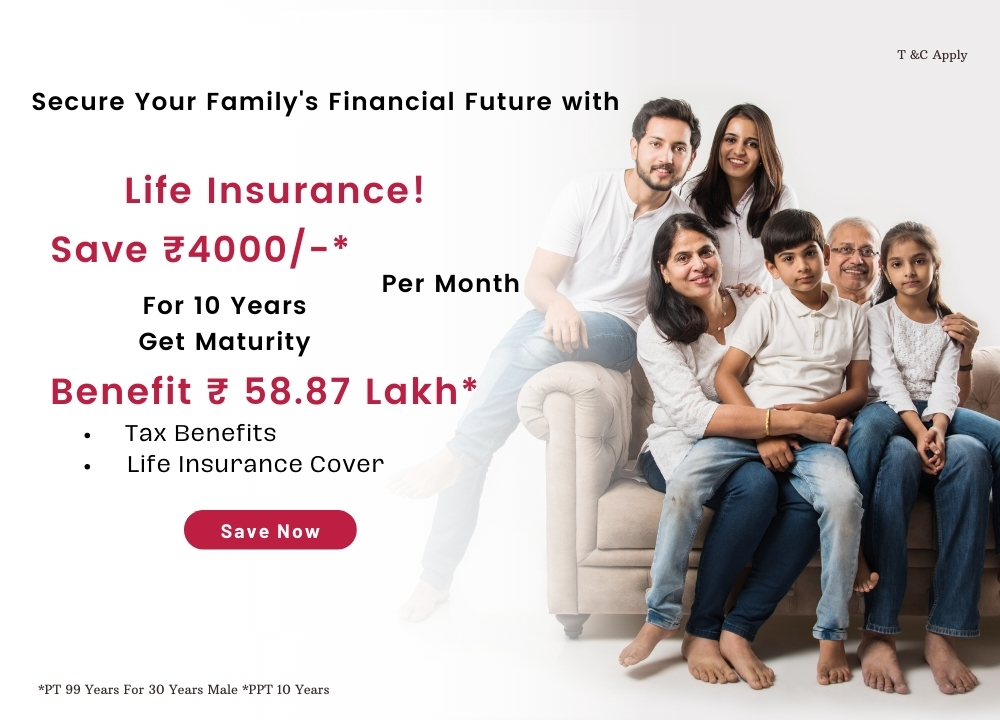

GET A FREE QUOTE TODAY!

What is ULIP?

ULIP stands for unit linked insurance plans. ULIP is a combination of insurance and investment. From a ULIP, the goal is to provide wealth creation along with life cover where the insurance company puts a portion of your investment towards life insurance and rest into a fund that is based on equity or debt or both and matches with your long-term goals. These goals could be retirement planning, children’s education or another important event you may wish to save for. Here policyholder can pay a premium monthly or annually. A small amount of the premium goes to secure life insurance and rest of the money is invested just like a mutual fund does. Policyholder goes on investing through the term of the policy – 5,10 or 15 years and accumulates the units. ULIP offers investors options that invest in equity and debt.

Importance of ULIP

Life cover

Unit Linked plans provide life cover additionally to high returns with a sum assured just in case of loss of lifetime of the policyholder.

Finance future funds

The longer you invest in ULIPs the higher the return you'll expect, hence funding you on long terms. it's greater rewards than other insurances.

Liquidity once you need it

The ULIPs provide options of partial withdrawal when and the way ever needed.

Disciplined and regular savings

The ULIPs are invested over a good range of funds, which may be altered as per the appetite of risk and return of the policy holder.

How Can You Save Tax By Investing In A ULIP?

1.Tax Benefits under Section 80C

The amount invested in a ulip is eligible for a deduction under Section 80C. The maximum amount that is eligible for the deduction is Rs.1, 50, 000

2. Tax Benefits under Section 10(10D)

The maturity amount in a unit linked insurance plan (ULIP) is fully excluded from Income Tax under Section 10(10D). When the premium paid is more than 10% of the sum assured for policy issued after 1st April 2012 or more than 20% for policies issued prior to 1 April 2012, the maturity amount received from ULIP policy is fully taxable.

Why you should invest in ULIPs?

Two Main Reasons Why Should You Invest In An ULIP Early On

The Power Of Compounding

Balance Investment Portfolio

Reasons Why You're Bound To Love Us Back