GET A FREE QUOTE TODAY!

Endowment Policy

These are the traditional form of insurance plans that offer an individual a life cover with very low profit. Endowment plans are usually taken by individuals who are looking to increase the value of fund plan but one which offers them guaranteed profits in lieu of a higher life cover. These plans are the best investment plan for investors who are not looking for a large corpus funds but are actually more concerned about keeping their funds safe and secure, for a period of time so as to increase the amount of profit returns.

Features of Endowment Policies:

Death along with Survival benefits

The nominee/beneficiary gets the sum assured along with bonuses, in case of the demise of the insured before the maturity of policy. And, the insured is entitled to get the sum assured if s/he outlives the policy

Higher returns

An endowment plan not only provides financial protection to the family and dependents of the policyholder in case of the unforeseen demise of the insured but also helps build a corpus for the future. Whether it is the survival benefit or death benefit, the payout of an endowment plan can be much higher than that of a pure life insurance policy.

Premium Payment Frequency

The policyholder can make regular, single or limited payments of the premium based on the policy chosen by him/her. One can also choose to pay in frequencies on the yearly, half-yearly, quarterly, or monthly basis.

Flexibility in Cover

Policyholders can add riders, such as critical illness, total disability, and accidental death, to the plan and increase their life cover. A few plans also give offer premium payment waiver in case of permanent disability or critical illness.

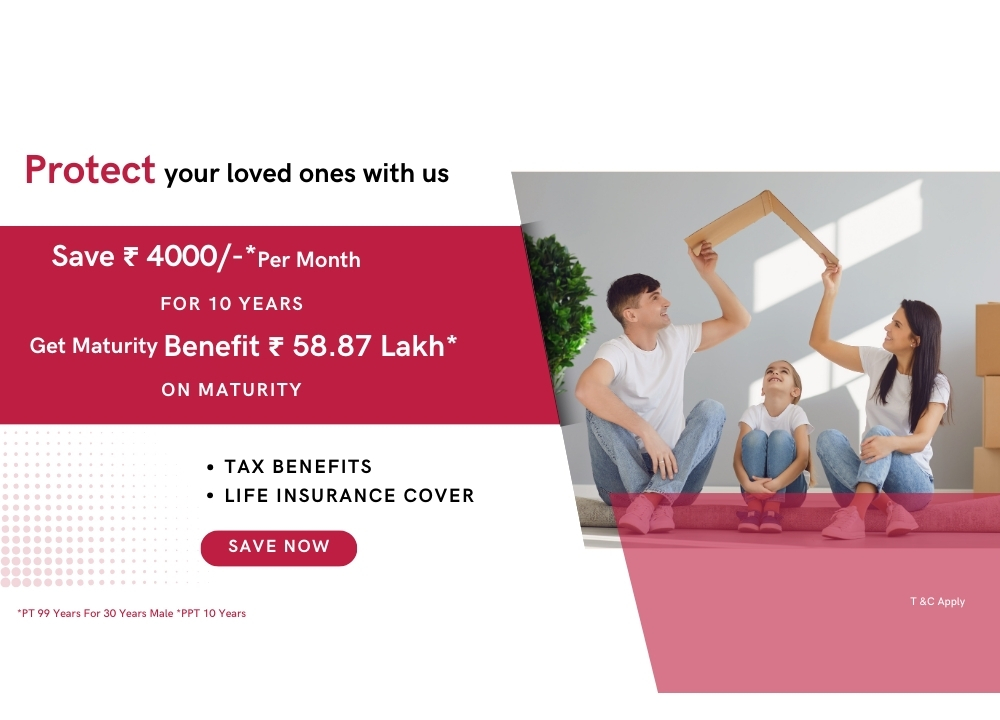

Tax Benefits

The policyholder gets tax exemption on both the premium payments and maturity or final death payouts, under Section 80C and Section 10(10D), respectively.

Low Risk

Endowment policies are safer as compared to other investments like mutual funds or ULIPs, as the amount is not invested directly in equity funds or the stock market.

Additional Bonus on Endowment Policy

There are various types of bonuses declared by an insurance company. Bonus is an extra amount of money additional to the proceeds, which is distributed to a policyholder by an insurer. Only holders of with-profits policy are entitled to a share in these profits and the payment of this bonus is conditional on the life insurer having surplus funds after claims, costs, and expenses have been paid in particular year. The bonuses are classified as Reversionary Bonus, Additional money added to the amount payable on death or maturity of with-profits policy. Once a reversionary bonus has been made it cannot be withdrawn if the policy runs to maturity or to the death of the insured.

Terminal Bonuses

A discretional additional amount of money added to payments made on the maturity of an insurance policy or on the death of an insured person.

Rider Benefits

There are various additional rider benefits that are available for you to choose from as per your requirement certain additional benefits are as follows that cater to your comprehensive coverage.

- Accidental Death Benefit

- Accidental Permanent Total

- Partial Disability Benefit

- Family Income Benefit

- Waiver of premium Benefit

- Critical Illness Benefit

- Hospital cash Benefit